Here’s a scene I bet you’re familiar with: You just started a new job and are setting up your benefits—or it’s open enrollment season—and you hit the section about your retirement plan. A seemingly simple prompt appears:

“Choose your contribution type: Pre-tax or Roth.”

You pause and think: “Everyone says Roth is the way to go, but is that actually true for me? Does it really matter?”

These are great questions because the answers, like most answers to great questions, aren’t one-size-fits-all.

In this blog, we’ll break down the key factors that influence whether you should contribute to a Roth 401(k) or a traditional pre-tax 401(k), and give you a simple framework to help you make a choice. If you’re still unsure after reading, feel free to reach out—this is a decision I guide people through all the time

Before we dive into it, does it really matter which one we choose? Yes, it does.

Your money will go to four possible places - you (by you spending it), people you love (via inheritance or gifting), charities you care about (donations), or the state/federal government (via taxes). I don’t want to put words in your mouth, but I imagine we want to give the least amount possible to that last one. This is why tax planning is important, the goal is to reduce your lifetime tax liability, so that money goes to the other 3.

Step 1: Understand Your Marginal Tax Rate

Having an understanding of your total marginal tax rate is key. Not only is this important for this decision, but it’s a good thing to know in general for a well-structure financial plan.

What Is a Marginal Tax Rate?

In the U.S., we have a Federal progressive tax system. That means your income is taxed in chunks—your first dollars are taxed at 10%, the next chunk at 12%, then 22%, and so on.

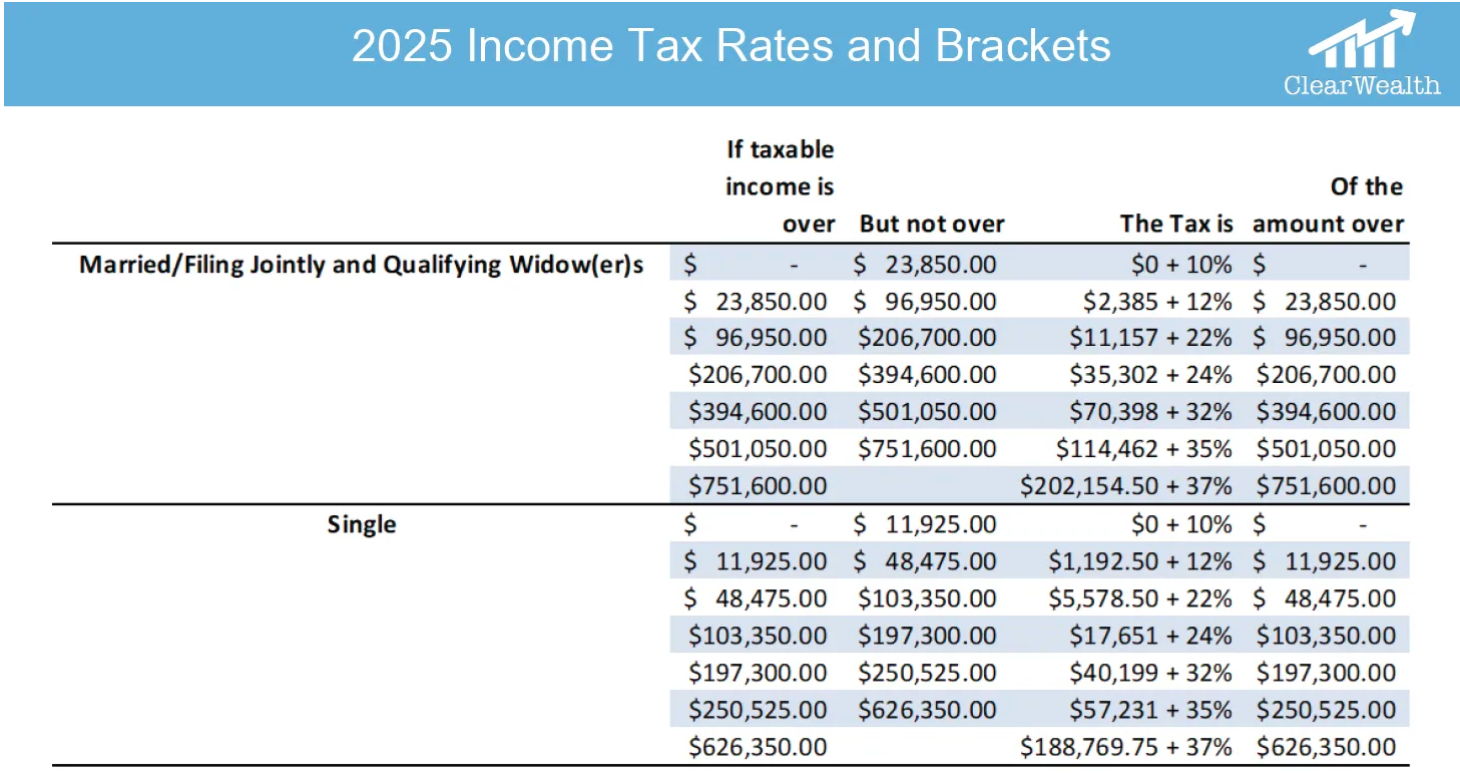

Here’s the 2025 Federal marginal tax brackets and rates:

So even if you’re “in the 24% bracket,” only the income in that bracket is taxed at 24%—not your entire income.

How to Estimate Your Tax Bracket

- Add up your income (yours and your spouse’s, if filing jointly).

- Subtract the standard deduction:

- $30,000 for Married Filing Jointly

- $15,000 for Single

- Use the IRS tax brackets to find your top marginal rate.

Then, factor in state income taxes. I’m based in Iowa, where we now have a flat 3.8% state income tax. Some states have flat taxes, some have progressive systems, and a few (like Florida and Texas) have none.

Add your federal and state rates together to get your total marginal tax rate.

Step 2: Choose Between Roth and Pre-Tax Contributions

Now that you know your total marginal tax rate, here’s a simple framework to help guide your decision.

If Your Total Tax Rate Is Under 25% → Consider Roth

- Your current tax rate is relatively low. Therefore the tax savings today isn’t huge.

- Roth contributions are taxed now, but grow tax-free and are withdrawn tax-free in retirement.

- We’re currently in a historically low tax environment, so paying tax now may be better than later.

- Simply put, money goes into the Roth taxed at a low rate, and never gets taxed again (as long as certain rules are followed).

If Your Total Tax Rate Is Over 30% → Consider Pre-Tax

- You’re in a high-income phase of life and more than likely, your income will not be as high when you are no longer earning, therefore you’ll have a lower rate.

- Money goes in untaxed while you’re in a high rate, and comes out taxed at a lower rate.

If You’re in the 25%–30% Range → It Depends

- This is the middle zone where additional planning helps.

- Project your future retirement income. Will your tax rate be higher or lower then?

- If you’re unsure, consider splitting contributions between Roth and pre-tax.

What if you’re in these higher brackets, but you still want to get money put away in Roth. Many people think if their income is too high they are not able to contribute to a Roth IRA. Backdoor Roth IRA contributions, and strategic Roth conversions are ways to get money into the tax-free Roth while you’re still putting money away Pre-tax.

Step 3: Additional Factors to Consider

While your tax rate is the biggest driver, other variables could tip the scales.

🔹 Do you expect a pension?

- Pensions reduce your ability to manage taxable income in retirement.

- If so, Roth may give you more flexibility and reduce future tax burdens.

🔹 Want more control in retirement?

- Pre-tax accounts require RMDs (Required Minimum Distributions) starting in your 70s.

- Large pre-tax balances can force you into higher tax brackets in retirement.

🔹 Planning to retire in a no-tax state?

- Some states (like Texas or Florida) have no income tax.

- Others (like Iowa and Illinois) don’t tax retirement income, which can make Roth contributions even more attractive.

🔹 Have a taxable brokerage account?

- One of my favorite retirement strategies: Use taxable accounts early in retirement (taxed at lower capital gains rates) while doing Roth conversions at low income levels.

- This can potentially save hundreds of thousands in taxes over your lifetime.

🔹 Planning to retire early?

- More years to strategically convert pre-tax dollars to Roth.

- Early retirement + taxable assets = great Roth conversion window.

🔹 Do you think tax rates will rise?

- No one knows for sure, but tax rates are set to increase after 2025 unless Congress acts.

- Roth contributions hedge against future tax hikes—but speculative decisions should be balanced with current facts.

Final Thoughts

If you’re looking for the simple takeaway, here it is:

- Tax rate under 25%? Lean Roth.

- Tax rate over 30%? Lean Pre-tax.

- Tax rate between 25%–30%? Do a little planning—or split contributions.

The good news? This isn’t a one-time decision. You can adjust your contribution strategy every year based on your evolving income and goals.

And if you’d rather not navigate this alone—I’ve helped dozens of couples and individuals make this exact choice. Let’s run the numbers together and make sure you’re maximizing every dollar.

P.S. If you want to…

- Spend more time doing the things you love

- Spend less time worrying about your financial future

- Feel confident you’re capitalizing on opportunities while minimizing potential threats

- Experience peace of mind about your financial security

Schedule a free, no-obligation introduction meeting with me without the worry of being sold something.

Still have questions?