I am, by definition, a Twitter lurker. Aside from the occasional reply to a fellow Financial Planner’s tweet or likes of Iowa basketball or football highlights, I rarely post anything.

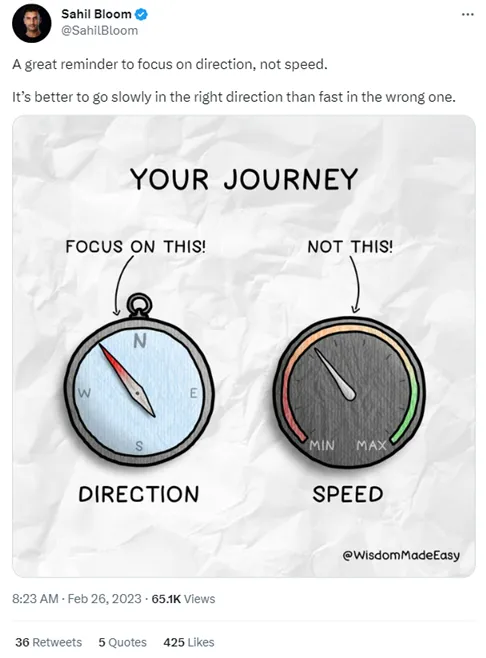

Being the professional lurker that I am, I constantly see content creators share incredible messages. If you are on Twitter, you may have stumbled across Sahil Bloom. One of his recent tweets stood out to me:

Great stuff.

Although this is fantastic advice for life in general, it’s especially true about your financial journey. We should, at all costs, avoid spending our time, attention, and money with the pedal to the metal without thoughtful direction in mind. The issue is that figuring out where your True North lies is difficult.

My advice for this is simple. Try not to think of specific, scary, momentous goals. Instead, think about what you value and figure out your financial purpose. Don’t overthink it. You can fall back on this when contemplating a financial decision. Ask yourself, “Does this serve my financial purpose?” It’s all about aligning your money with what’s important to you.

Once you find where that is, then you can focus on your speed. Increase your savings rate by $100, $500, or 1% annually. It may not seem like much at the time, but before you know it, you’re going 79mph down I-80. (9 you’re fine, 10 you’re mine, right?).

Specific goals like becoming financially free by age X or having Y amount of dollars invested are great, and they’re like a magnet pulling you towards them. Alas, goals change, and that’s okay. But your sense of purpose (mostly) does not; if it does, hopefully, it’s not very often. This can aid in creating long-term stability about where you want to go.

I hadn’t heard Sahil’s rendition before seeing that tweet. Still, it reminds me of the quote by Stephen R. Covey, author of the book The 7 Habits for Highly Effective People “If the ladder is not leaning against the right wall, every step we take just gets us to the wrong place faster.”

What wall do you want to climb?