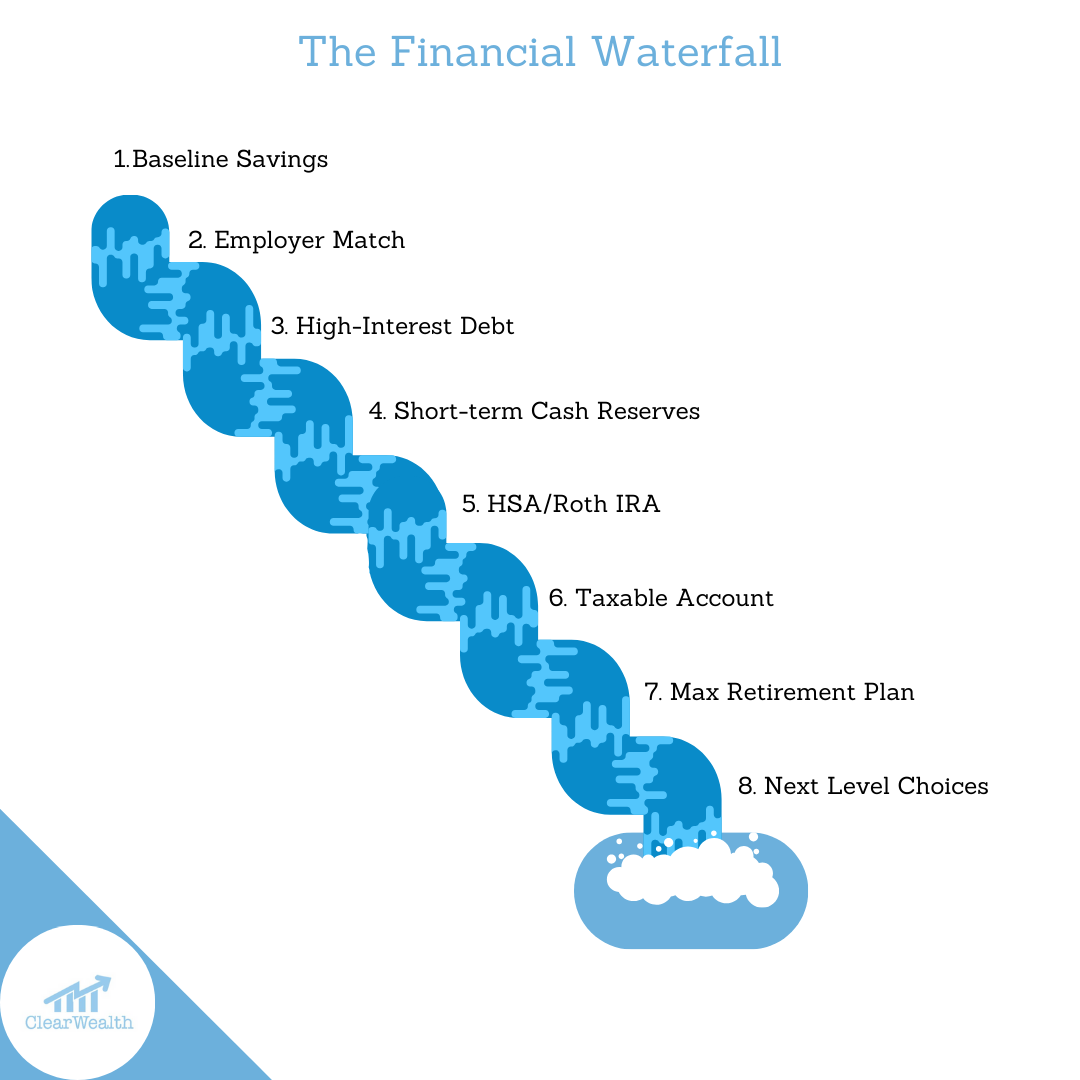

I hesitate to make blanket statements. Everyone has different financial situations and ideas about their ideal future (i.e., goals). However, if you are at a surplus of income and wonder, “Hey, what should I be doing? Where should I be putting my money?” I have a guide for you that I call The Financial Waterfall.

The first place to start is building your baseline cash savings. This is highly liquid money (you can access it very quickly). That baseline cash savings should be at a level that you can cover your insurance deductibles or minor unexpected expenses. For example, let’s say your health insurance deductible is $3,500. Start with having $3,500 in a high-interest savings account.

Okay, so we have a small amount saved that can weather most minor storms. If you are at an employer that offers a retirement plan with a match, contribute to get the entire match. Every employer is different, so this varies from person to person. But that is compensation your employer provides; take advantage of it, and don’t leave that money on the table; you work hard for it.

Next would be paying down your high-interest debt. This could be credit cards, personal loans, private student loans, or car loans. My general thought process is if it’s above 5-6% interest, attack it. This does two things for you. It saves you money on the interest you would have paid by just paying the minimum payment, and it frees up that cash flow to save and spend on yourself.

Once the high-interest debt is resolved, we move on to the next step: increased short-term cash reserves. Your cash reserve solves several problems. It’s an emergency fund that pays for unexpected expenses to avoid getting back into high-interest debt; it also funds your short-term goals like going on a family vacation, doing home improvement projects, or funding a down payment for a vehicle. And lastly – this is more psychological than anything – it provides comfort and flexibility. From a pure emergency fund standpoint, aim for 3-6 months of your expenses. Anything above and beyond that amount funds those short-term goals and provides peace of mind.

Next, look to maximize tax-advantaged investment accounts. If you are in a high-deductible health plan, contribute to the HSA. This is the only type of account that offers a triple tax benefit. It’s one of my favorite topics to discuss when planning for my clients; this account is a massive opportunity for your future. Then look to your Roth IRA and strive to max that out as well.

If we are maxing out the tax-advantaged accounts, then move on to starting a taxable investment account. This is money that’s not necessarily earmarked for long-term goals like retirement. It’s your mid-term investment bucket that does not have contribution limits or any early withdrawal penalties. It’s very flexible and can help fund those more significant purchase mid-term goals.

If you are doing all of the previous steps in the waterfall, congratulations, you are absolutely killing it financially. Keep that momentum up. The next thing we can do is start supercharging your retirement savings by increasing your contributions to your employer retirement plan. These accounts have contribution limits, so if you can max this out, you are taking full advantage of the tax-efficient investment accounts.

Now we’re at a point where we are maxing out all of the tax-advantaged investment accounts, we have eliminated high-interest debt, and we have a taxable investment account for mid-term goals. What’s next?

Well, my friends, the world is your oyster. What do you want? Do you want to invest in real estate? Do you want to become debt-free? Do you want to start a side hustle that can become a business?

If you can follow this guide, you will address all of the fundamentals to set yourself up for massive success in the future.

I get that income plays a huge role in how far you can get down the list, and that’s okay. Follow these steps and do what you can to maximize your income. If you can get to step 5, you are ahead of most and have earned the right to achieve financial freedom.

While I know everyone lives a different life, The Financial Waterfall provides a practical guide for those fortunate with a surplus of income seeking to make wise financial decisions. As you progress through the waterfall, achieving financial milestones, you gain the flexibility to pursue your dreams.

Remember, the journey to financial freedom is unique, and income variations play a role. Still, by following these steps and maximizing your efforts, you are positioning yourself ahead on the path to lasting financial success. Keep the momentum, stay disciplined, and embrace the possibilities that come with securing your financial future.